Woeful economic data raises Brexit concerns

A couple of significant central bank figures are set to speak overnight, while markets digest the horrible data from the UK.

The USD continues to strengthen, pushing paired currencies down overnight. The EURUSD opened at $1.13197 and remained steady early, lifting to a high of $1.13295. Mid-session trading saw the beginning of the decline, as the euro struggled to stay above $1.13. The euro fell below that barrier, bottoming-out at $1.12664 late in the day. It is not far off that at the moment, currently trading at $1.12763. The GBPUSD suffered a similar fate to the euro, posting losses for most of the trading day. The pound opened at $1.29239 and was flat in early trading, bumping up to a high of $1.29383. The slide began shortly afterwards, with the pound falling to a low of $1.28439 late in the session. It is currently trading at $1.28597.

The Dow looked set for a positive session until a late fall saw it enter negative territory. The index opened at 25,114.77 and traded in a tight range early. Mid-session trading saw the Dow climb to a high of 25,246.26. The gains were given up over late-session trading as the Dow tumbled to a low of 25,003.26 before closing at 25,043.86. The Dax was in recovery mode overnight, steadying itself after the sell-offs over the previous few days. The German index opened at 10,960.48 and dipped to an early low of 10,939.09. It climbed to a high of 11,039.59 a short time later, while spending the rest of the session trying to stay above 11,000. The Dax closed at 11,003.09.

The day ahead is a relatively quiet one, allowing markets to digest and dissect the woeful economic data from the UK. The month-on-month GDP figure showed a contraction in the economy (-0.4% vs 0% expected), while the quarterly GDP figure also missed (0.2% vs 0.3% expected). They weren’t the only misses for the UK as Manufacturing Production (-0.7% vs 0.2% expected), Industrial Production (-0.5% vs 0.1%) and Construction Output (-2.8% vs 0.2%) all pointed to deepening economic concerns. The dragged-out Brexit negotiations are surely playing a part in these results, with decisive action required to put an end to the uncertainty.

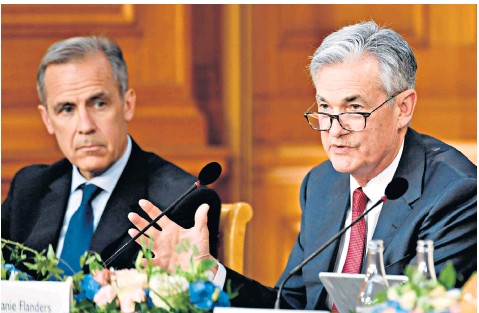

Markets will turn their attention to speeches from BoE Governor Mark Carney and Fed Chair Jerome Powell. Markets will be extremely interested in what these central bankers have to say in-regards-to economic outlook and future monetary policy settings.

Data released today includes:

Australia – Home Loans, NAB Business Confidence

Europe – ECOFIN Meetings, German Buba President Jens Weidmann speaks

Japan – M2 Money Stock, Tertiary Industry Activity, Prelim Machine Tool Orders

US – NFIB Small Business Index, JOLTS Job Openings, Mortgage Delinquencies

Disclaimer: The information in this website is of a general nature only and the advice has been prepared without taking account of your objectives, financial situation or needs. Accordingly, before acting on the advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs. We recommend you seek independent advice if necessary.

English

English 한국어

한국어 Spanish

Spanish Polski

Polski Malaysian

Malaysian française

française Vietnamese

Vietnamese Arabic

Arabic 中文

中文 Italy

Italy